pa estate tax exemption 2020

The County Board for the Assessment and Revision of Taxes will grant the tax exemption. Pay the PA inheritance tax early.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount.

. 1 Organization must be tax-exempt under the Internal Revenue Code. If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption. Get information on how the estate tax may apply to your taxable estate at your death.

Applicants approved after this date will receive a second bill. 0 percent on transfers to a. The tax rate varies depending on the relationship of the heir to the decedent.

Payment from real estate. Is made by an organization which is registered with the PA Department of Revenue as an exempt. 3 The organizations conduct must be primarily supported by government grants or contracts funds solicited from its own membership congregation or previous donors and.

Notice 2020-20 Federal income tax filing and payment relief on account of. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. Pa estate tax exemption 2020 Wednesday March 2 2022 The Homestead Exemption reduces the taxable portion of your propertys assessed value.

Ad Access IRS Tax Forms. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery. Wolf Announces Bonus Property Tax Relief Hitting Bank Accounts Now.

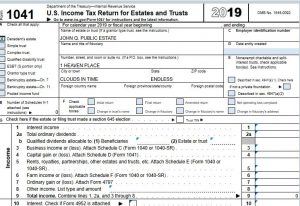

This election is made on a timely. Exclusion amount under 2010c and 2505 of the Internal Revenue Code and the generation-skipping transfer GST exemption under 2631 as they relate to. Estates and trusts report income on the PA-41 Fiduciary Income Tax return.

DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE. Ra-retxpagov Please do not send completed applications or personally identifiable. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. REV-714 -- Register of Wills Monthly Report. Robin Lloyd.

This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax Exemption when a purchase of 200 or more. 45 for any asset transfers to lineal heirs or direct descendants. Ad Download Or Email REV-1220 AS More Fillable Forms Try for Free Now.

Apportionment of Pennsylvania estate tax. Form 706 Estate Tax Return Packages Returned If your Form 706 package was returned to you you must. REV-1197 -- Schedule AU -- Agricultural Use Exemptions.

Estates and trusts are entitled to. This act supplements the act of July 9 1971 PL206 No34 known as the Improvement of Deteriorating Real Property or Areas Tax Exemption Act and the act of December 1 1977 PL237 No76 known as the Local Economic Revitalization Tax Assistance Act which implement section 2biii of Article VIII of the Constitution of Pennsylvania. Convert your IRA to a Roth IRA.

Apportionment of Federal generation-skipping tax. Harrisburg PA Today Governor Tom Wolf reminded Pennsylvanians that one-time bonus rebates for the Property TaxRent Rebate PTRR Program are bein. The conversion will come at a cost since you will need to pay an income tax on the conversion.

REV-720 -- Inheritance Tax General Information. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. Since the programs 1971 inception older and disabled adults have received more than 73 billion in property tax and rent relief.

Complete Edit or Print Tax Forms Instantly. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax Exemption when a purchase of 200 or more is made by an organization which is registered with the PA Department of Revenue as an exempt organization. Payment or delivery of exemption.

Property that is owned jointly between two spouses is exempt from inheritance tax. REV-1381 -- StocksBonds Inventory. Philadelphia PA 19115 REAL ESTATE TAX RELIEF HOMESTEAD Final Deadline to apply for the Homestead Exemption is December 1 2020.

Family Exemption 3121. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. Early filers should apply by September 13 2020 to see approval reflected on your 2021 Real Estate Tax bill.

2020 Estate Tax Exemption. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. The rebate program also receives funding from slots gaming.

2 No part of the organizations net income can inure to the direct benefit of any individual. The tax rate is. 15 for asset transfers to other heirs.

Pennsylvania Inheritance Tax Safe Deposit Boxes. The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. November 19 2019 Posted by RLA Estate Planning Law News and Press Probate Real Estate Law Tips Trust Administration.

They are required to report and pay tax on the income from PAs eight taxable classes of income that they receive during their taxable year. Download Or Email PA REV-72 More Fillable Forms Register and Subscribe Now. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

FORM TO THE PA DEPARTMENT OF REVENUE. 12 for asset transfers to siblings. The benefit of paying the income tax before you die though is that.

5089 Highway AIA Vero Beach Florida 32963. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Estates of decedents survived by a spouse may elect to pass any of the decedents unused exemption to the surviving spouse.

How To Close Or Settle An Estate In Pa The Martin Law Firm

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

2020 Estate And Gift Taxes Offit Kurman

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pennsylvania Orphans Court Lawsource Includes Book Digital Downlo Bisel Publishing

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased